There has been a great deal of commentary about the case for wealth managers, and clients such as high net worth and ultra-HNW individuals, putting money to work in private market areas such as venture capital, private credit and equity, forms of infrastructure, and real estate. There is, arguably, an element of hype here – and this news service has written about one or two sceptical notes amid all the noise. That said, the evidence appearing from surveys is that this asset class is gaining ground.

Claire Madden, founder and managing partner, , explains the market environment, the reasons why UHNW individuals are pushing into the sector, and what the future holds. The editors are pleased to share this content; the usual editorial caveats apply to views of outside contributors. Email tom.burroughes@wealthbriefing.com and amanda.cheesley@clearviewpublishing.com

In a year where global markets have been anything but predictable, one trend has proven remarkably resilient: ultra-high net worth HNW investors’ appetite for private markets.

Connection Capital’s latest research reveals that allocations to private equity and other private market strategies remain not only intact but deeply embedded in portfolios – despite reduced exit activity and ongoing political uncertainty.

Allocations remain robust

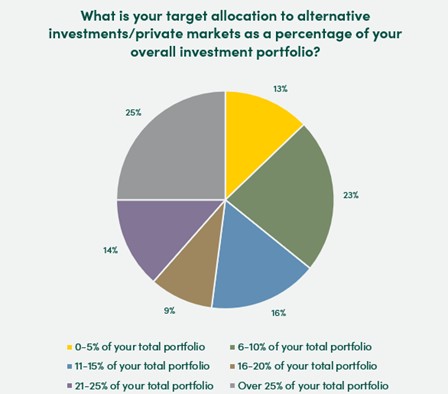

Our annual alternative investments survey, conducted across a predominantly UK-based UHNW and HNW client base, shows that two-thirds of respondents target an allocation to private markets of over 10 per cent of their portfolio, with 40 per cent targeting more than 20 per cent. One in four allocates over 25 per cent – consistent with last year’s figures, underscoring just how structural this trend has become.

Figure 1: Target Allocation to Private Markets

The pursuit of outperformance

When asked why they allocate to private markets, 78 per cent cited higher return potential than public markets as the primary driver. This conviction persists despite the illiquidity associated with private marked investments. Indeed, for investors with a long-term horizon, illiquidity is a price worth paying: 85 per cent of respondents are content to accept capital locked up in exchange for the potential of superior returns, while only 15 per cent would trade some return for more liquidity. This signals confidence that, with the right access and due diligence, private market investments can deliver meaningful alpha – a theme that wealth advisors should not ignore.

Private markets expected to deliver most attractive investment opportunities

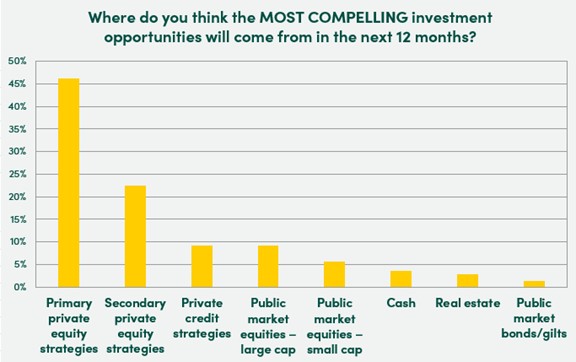

Investors are unequivocal in identifying private markets rather than public markets as the source of the most compelling opportunities over the next 12 months.

Figure 2: Most Compelling Investment Opportunities

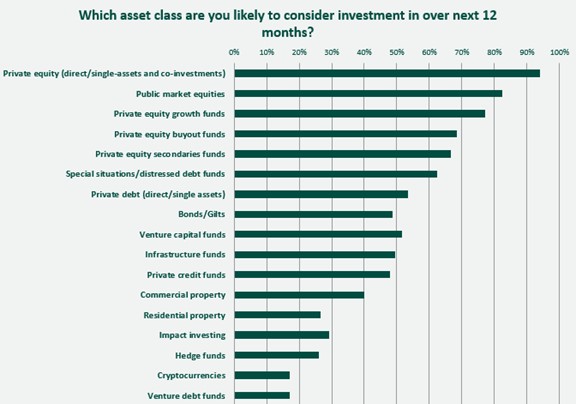

Looking at specific asset class preferences and the likelihood of considering over the next year, the data is emphatic: single-asset private equity investments and co-investments top the list, with an overwhelming 94 per cent of respondents likely to consider them in the next 12 months, alongside – as expected – a strong showing for traditional public market equities. Private equity growth funds (82 per cent) and buyout funds (77 per cent) also rank highly, while interest in PE secondaries remains strong at over two-thirds of respondents.

Figure 3: Private Market Asset Class Preferences

UK and Europe in focus, US sentiment softens

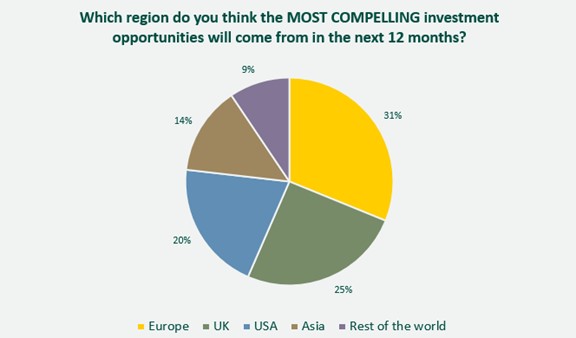

When it comes to geography, Europe (31 per cent) and the UK (25 per cent) emerge as the most compelling regions for new opportunities, while sentiment towards the US has cooled, with only 20 per cent of investors naming it their top choice. Political and economic unpredictability stateside appears to have tempered enthusiasm, while investors see UK and European markets as offering more stability and attractive entry points.

Figure 4: Most Compelling Regions for Investment

Why should advisors care about private markets?

Wealth advisors can no longer ignore private markets. Client appetite for alternative investments is at an all-time high, driven by the search for enhanced returns and diversification. And access to these opportunities is becoming a key differentiator.

Advisors who fail to provide solutions risk losing relevance – and clients – to those who can. In an era where companies are staying private for longer and investors are more cognisant of where the most compelling investment opportunities lie, creating pathways for private market participation is not optional; it’s essential for staying competitive and safeguarding long-term client relationships.

Looking ahead

Despite a challenging macro backdrop, investor sentiment towards private markets is unwavering. The opportunity set is evolving, but the fundamental drivers – outperformance potential, diversification, and alignment with long-term goals – remain intact. The case for private markets has arguably never been stronger and the challenge for advisors is ensuring that their clients have access.

About the author

Claire Madden is founder and managing partner at Connection Capital, a UK-based private markets and alternative investment platform providing UHNW and HNW investors with access to direct private equity and debt transactions, as well as institutional-grade fund strategies. Madden has more than two decades of experience in alternative investments and is a frequent commentator on private markets.

Source: Connection Capital Alternative Investments Research, July 2025.